Business is not anyone’s cup of tea and talking about the rising startup ratio, it is a tough market around. Bringing the new customer each day is a challenge. The attitude is prone towards “acquiring” customer lifetime value which is the main question of each business that has been raised today.

“Acquiring customers is an investment in the future of your business. Spend wisely, measure diligently, and reap the rewards of sustainable growth.”

Running a business is not just limited to “new ideas” but is purely amalgamation and constant urge to acquire new customers, maintain the number of new customers, marketing efforts, profitability, sales and marketing expenses, a total business metric of profit, marketing spend, return on investment and much more. Customer success is not an easy task but the benchmark has to be set where cost is designed to measure the profitability of your acquisition teams. In this blog, we will purely understand what is the cost of acquiring a new customer and much more related to marketing and sales.

Key Takeaway :

To reduce customer acquisition cost, focus on optimizing the sales and marketing funnel to improve the cost of acquiring customers, experiment with pricing, strengthen sales and marketing efforts, and engage with customers better to build trust and reduce costs. Understanding and implementing these tactics can lead to a decrease in customer acquisition costs, ultimately improving the overall profitability of the business.

What is Customer Acquisition Cost?

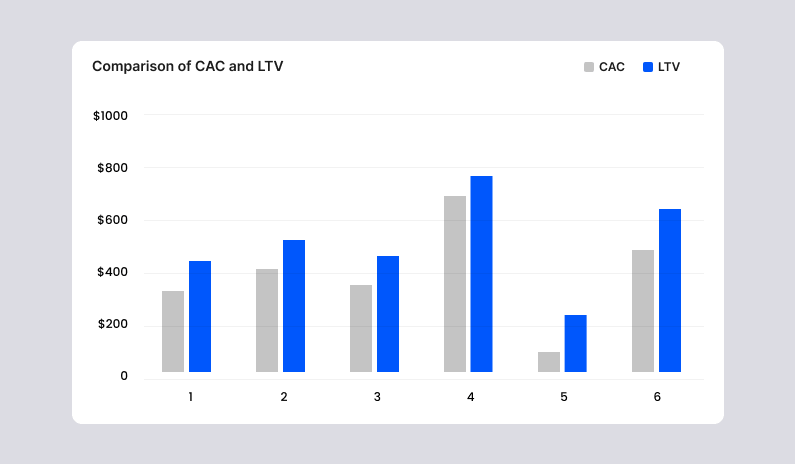

Customer Acquisition Cost is simply the total cost to acquire a new customer, in a way money spent on various tactics to increase the number of customers in the business. Whether you own a product or service business, it is always important to have strong customer engagement. When do you know your business is successful? When your CAC is lower than LTV. This means if you calculate customer acquisition cost, it should be lower than the lifetime value of the customers. In a way CAC ratio should be lower. Maintaining the customer relationship is surely a task but this is where we stand to help you how to improve customer retention along with the relationship and knowing CAC would help in maintaining better marketing costs.

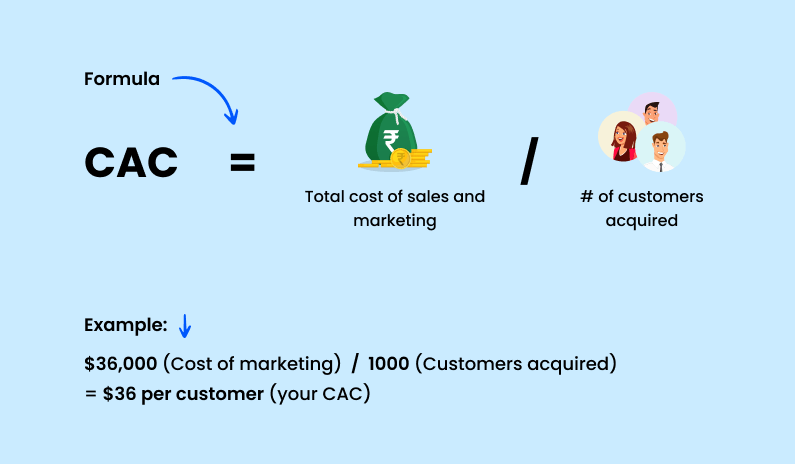

How to Calculate CAC?

Let’s understand how CAC is calculated before jumping into anything further/You can calculate CAC with the typical CAC formula and divide by the number of the total cost of acquiring customers. With the total number of customers acquired in a particular given time. In a way, new customers acquired will be calculated in a particular given time and we might get the average customer to buy a product.

The Formula:

CAC = (total cost of sales and marketing) / (# of customers acquired)

Example: If the total cost of marketing campaigns is = $36,000 for 1000 customers, what is your CAC?

Your CAC is 36,000/1000= $36 per customer.

This is a simple calculation of cost acquisition and you can now improve customer acquisition cost that will improve the value per customer spend. Customer Acquisition cost varies according to what your business spends on sales and marketing efforts. CAC is an important thing to always note down when you are running a business otherwise it will be equivalent to a blind person running on a busy traffic road, never knowing when it will be crashed. If a CAC is too high then you need to figure out and understand how acquisition cost is designed that it is losing potential customers. Total sales and marketing spend should be giving at least an average of new customers in the business.

Is Customer Acquisition Cost Important in Product Management?

The cost of acquiring a customer is directly proportional to the future of any business. Considering the marketing and sales expenses, it is important that there is a better ROI. Acquisition cost is to determine the average customer lifetime value. The cost of acquisition is to attract new customers and customer costs set up the industry benchmarks. The cost includes every single purchase or spent on marketing to acquire a new customer. Apart from just getting customers to your business, it is much more important to figure out the tactics for customer relationship management and hence take care of three times the cost spent on the same. Let’s know why CAC is important in product management.

Calculate customer acquisition cost with Customer Lifetime Value

At least every 4 months you should calculate the cost to acquire new customers by analyzing CAC and LTV. The value of your customers will be handy in front of you for drawing your business plans. Customer-to-purchase ratio plays an important part after acquiring new customers whether they are here to buy a product or service whatever business you run, depends on you. The particular benchmark should be set to conquer your goals of CAC

At least every 4 months you should calculate the cost to acquire new customers by analyzing CAC and LTV. The value of your customers will be handy in front of you for drawing your business plans. Customer-to-purchase ratio plays an important part after acquiring new customers whether they are here to buy a product or service whatever business you run, depends on you. The particular benchmark should be set to conquer your goals of CAC

Determine the Payback Time of the customer cost and LTV

As soon as there is an additional customer in your business, there is a cost that is billed up in the business. The main thing to determine in the business is to see getting money back instantly as humanly possible just like a payback time in the business. Determine the business that is growing in the business because of that particular customer and that particular time is considered to be the payback period time of the business where you will know the importance to use CAC.

Also Read: How to Build Customer Loyalty and Trust?

Strategies to acquire Low CAC with better business proft. This will take the business to a better road and a long route to reduce CAC further.

Track CAC Industry Benchmark Metric

What is the purpose of the business that you are building? Bringing change? or Ruling the market with your service or product! It can be anything that determines the business’s meaning. When it comes to the CAC tracking, it is truly important to know and be wise about what and how are you spending a penny in your business. It also includes the salary of your marketing team and the number of customers getting on the Lifetime Value List. Track for bringing better results in the business.

How can you lower your CAC?

We know the Four Best ways to lower your CAC that will help to decrease in a lot of costs by doing some minimal efforts. Why CAC is designed? It is purely designed to keep a record of the total expense of your expenditure and your team which brings up the huge phenomenon change in the ratio of the LTV and CAC. Lowering down CAC rate with some tactics is something we would like to share it with you to bring effortless change in your business, I am sure it is implementing worthy. Let us understand some of the tactics.

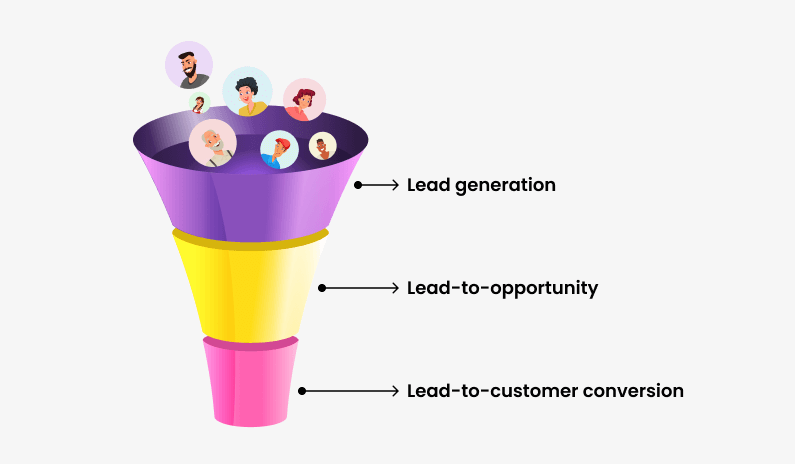

Sales and Marketing Funnel Optimization to Improve Customer Acquisition Cost

Understanding the implementation in the marketing and sales process of your business that will help to know the actual lead in your business that is coming.  Knowing the ratio of lead-to-lead generation, lead-to-opportunity, and lead-to-customer ratio will help in keeping a record of the total customers in the business with the cost spent. Know the customer behaviour towards your brand and business.

Knowing the ratio of lead-to-lead generation, lead-to-opportunity, and lead-to-customer ratio will help in keeping a record of the total customers in the business with the cost spent. Know the customer behaviour towards your brand and business.

Experiment with the Pricing of your Service, Product, or Startup Business

It is important to provide value to customers according to your price range in the business. There are certain things that need to be taken care of when deciding the price range amongst customers. Make sure that your CAC period is not always in the recovery mode and yet always in the decreasing mode compared with the number of customers coming through knowing the price range of your business. Not only that but decide the price range that stands and justifies the CAC calculation in the business.

Make your Sales and Marketing Stronger

Observe, Experiment, and Implement what marketing tactics work for your business. Make the investment where you think has the stronger ability on ROI and make the funnel stronger. Doing this will make sure that not a single penny is been wasted or burning any holes in the pocket.

Observe, Experiment, and Implement what marketing tactics work for your business. Make the investment where you think has the stronger ability on ROI and make the funnel stronger. Doing this will make sure that not a single penny is been wasted or burning any holes in the pocket.

Engage with Customers better to reduce CAC

Engaging with customers brings better responses to your business ultimately gaining more trust. In the business, the prior concern of the customer is always the trust factor, the factor that will take time to create but the one-to-one interaction with customers impacts the a lot in the business. Engage better and faster.

Engaging with customers brings better responses to your business ultimately gaining more trust. In the business, the prior concern of the customer is always the trust factor, the factor that will take time to create but the one-to-one interaction with customers impacts the a lot in the business. Engage better and faster.

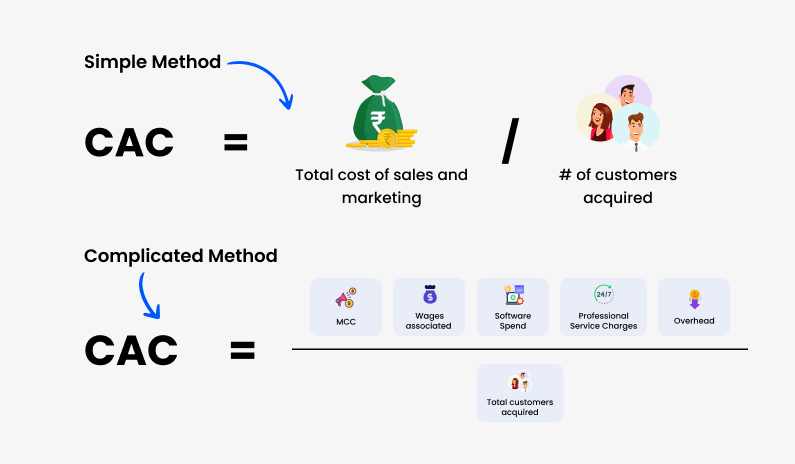

What things include in a CAC Calculation?

By now, we already know how to calculate CAC with the simple formula given but what other things need to be considered while calculating CAC? Simple Method: CAC = MCC ÷ CA MCC: Marketing Campaign Cost CA: Custome Acquired Complicated Method: CAC = (MCC + W + S + PS + O) ÷ CA MCC: Marketing Campaign Costs W: Wages associated S: Software Spend PS: Professional Service Charges O: Overhead CA: Total customers acquired

Conquer Customer Acquisition Strategy (FAQs)

Why use CAC for your business?

To determine a company’s CAC, the total expenses for sales and marketing are divided by the number of new customers acquired during a given timeframe. For instance, if Tommy invested $10 towards promoting his lemonade stand and obtained 10 customers in one week, his cost per acquisition for that period is $1.00.

What is CAC Formula?

Whether a business has a favourable customer acquisition cost (CAC) largely depends on its industry type and its approach to garnering new clients. In the SaaS sector, evaluating CAC in relation to the customer lifetime value (LTV) can serve as a gauge of a company’s operating conditions. A CAC: LTV ratio of 3:1 is widely regarded as optimal.

How much of CAC is considered to be the best CAC?

A good CAC depends largely on the type of industry and the strategies implemented by a business to get new customers. SaaS businesses usually compare CAC to a customer’s lifetime value (LTV) as an indicator of business health. The ideal CAC: LTV ratio is widely accepted to be 3:1.